Actively choosing your super investment option

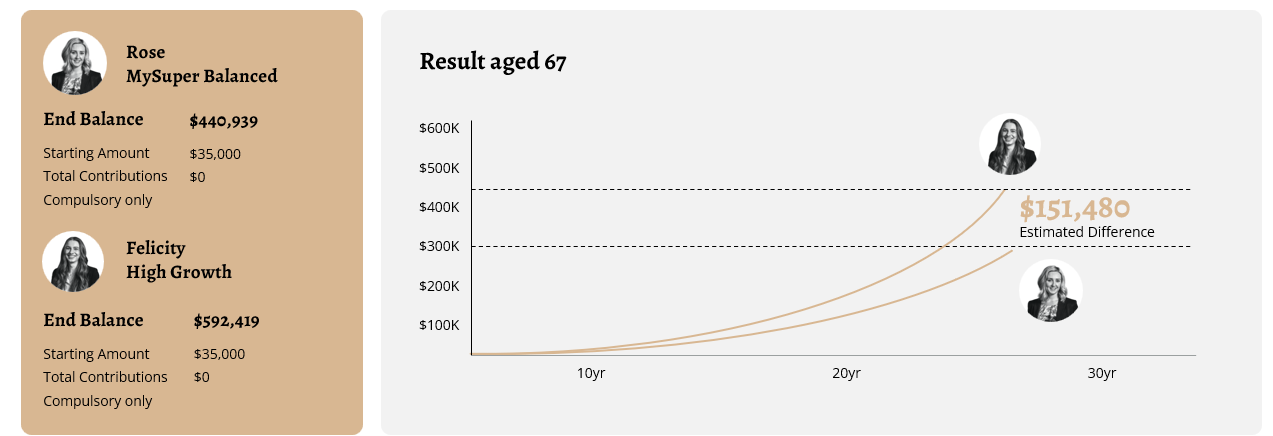

Did you know you could boost your super by approximately $150,000 just by reviewing and updating your investment option?

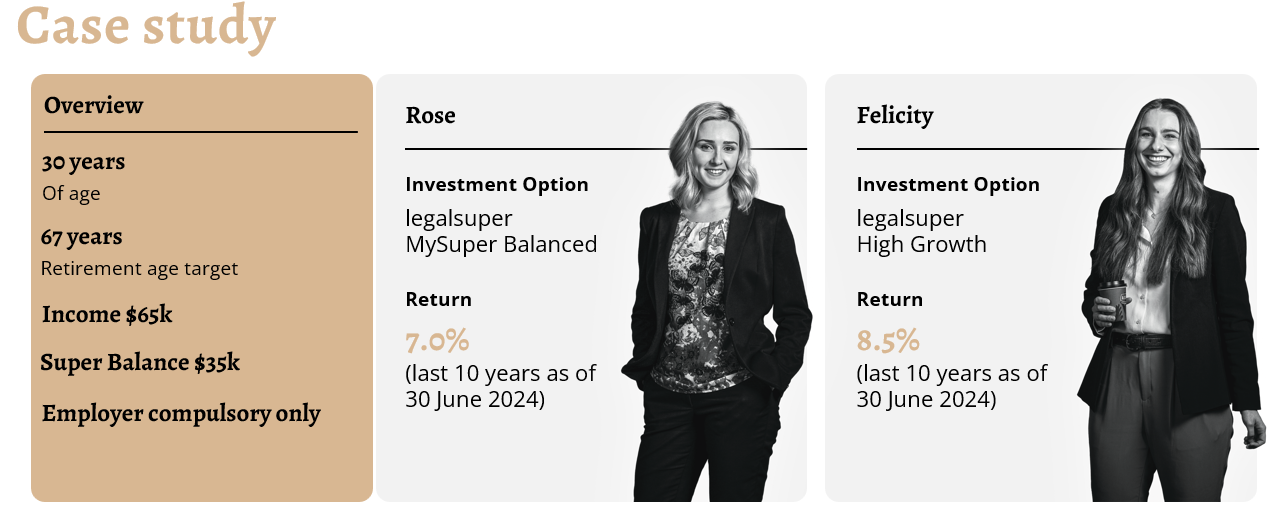

Let’s take Rose and Felicity as an example. Both are 30 years old, earn $65,000 per year, and have a starting balance of $35,000 in their super.

Rose is in the default MySuper Balanced investment option, where most people are invested, and she’s on track to retire with about $440,939.

Felicity, on the other hand, decided to switch to the High Growth investment option. With that one simple change, she’s set to retire with $592,419 – an extra $151,480.

The difference? Felicity took advantage of time in the market and opted for a higher return investment, knowing she could ride out market fluctuations over the long term. Same income, same starting balance, and no extra contributions – just a different investment strategy.

And if you are even younger and have more time, compound interest could amplify your results even further. The sooner you pay attention to your investment strategy, the more powerful it could be.

Curious about your options? Book a complimentary 1:1 session with one of our Client Service Manager.

This information is of a general nature. Please refer to the legalsuper PDS & TMD available at www.legalsuper.com.au before making any decision. Past performance is not a guide to future performance. Results are only estimates, the actual amounts may be higher or lower. We cannot predict things that will affect your decision, such as changing interest rates. The calculator used is not intended to be your sole source of information when making a financial decision. Consider whether to get advice from a licensed financial professional. The example is a model and not a prediction.

Calculator used for estimates: https://moneysmart.gov.au/how-super-works/superannuation-calculator Over the last 10 years, legalsuper’s MySuper Balanced Option returned 7.0% and High Growth has returned 8.5% as of June 30, 2024. The performance shown on this page is net of all tax and fees, except the weekly administration fee.